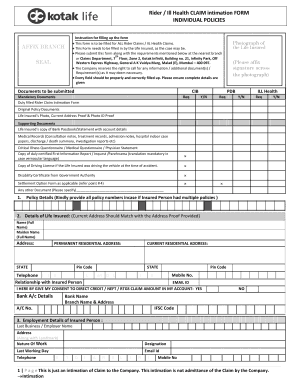

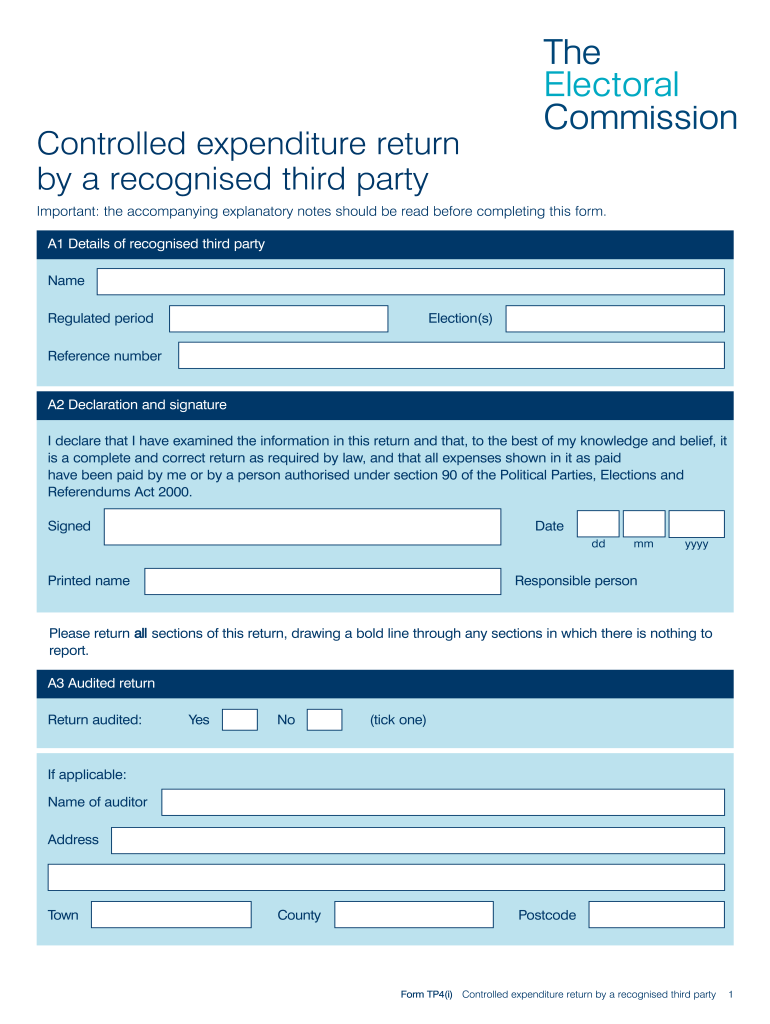

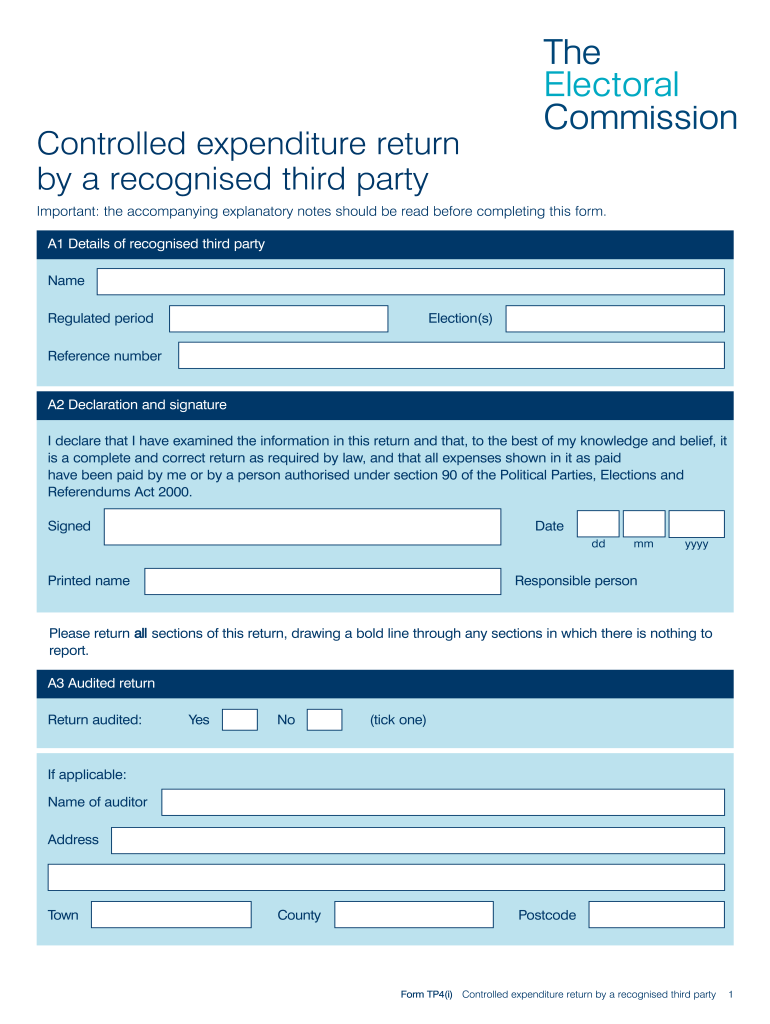

UK Form TP4i free printable template

Show details

B2 Donation return TP4 ii attached tick as appropriate Section C Payments made C1 Statement of actual payments Number of entries made in this section Item number Expense incurred Amount. pp Claim for payment Supplier Claim paid Part s of United Kingdom to which expenditure relates Invoice/receipt submitted Northern Ireland C2 Statement of notional expenditure Nature of expenditure Value. Item number Date/period incurred Value Supplier s details Note continuation sheets should be used to...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign expenditure return pdffiller form

Edit your controlled expenditure fill form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your expenses schedule income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit expenditure return fillable online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form controlled expenditure. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out iii taxation exemption form

How to fill out UK Form TP4(i)

01

Obtain a copy of UK Form TP4(i) from the official website or relevant authority.

02

Read the form instructions thoroughly to understand the requirements.

03

Provide personal details such as your full name, address, and contact information in the designated sections.

04

Fill in the specific information about the transactions or financial details being reported.

05

Include any additional documentation as required by the form.

06

Double-check all entries for accuracy before submission.

07

Sign and date the form as indicated.

08

Submit the completed form to the appropriate authority as per the instructions.

Who needs UK Form TP4(i)?

01

Individuals or entities involved in certain financial transactions in the UK.

02

Taxpayers who need to declare specific types of income or capital gains.

03

Residents or businesses participating in capital transfer schemes or trusts.

Fill

form expenditure recognised

: Try Risk Free

People Also Ask about

What is the difference between a w9 and tax exemption certificate?

Purchasers submit resale certificates to vendors, who typically initiate the request. The person or company making the payment, rather than the person receiving the payment, typically requests the Form W-9. The W-9 relates to federal income tax, while resale certificates relate to state sales tax.

What is an exemption on tax form?

An exemption is a dollar amount that can be deducted from an individual's total income, thereby reducing. the taxable income. Taxpayers may be able to claim two kinds of exemptions: • Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse)

What is a US tax exemption certificate?

The cards provide point-of-sale exemption from sales tax and other similarly imposed taxes throughout the United States. At the time of payment when making a purchase, the cardholder must present the card to the vendor in person.

Should I claim exemption on tax form?

Who Should Be Filing Exempt on Taxes? As noted above, you can claim an exemption from federal withholdings if you expect a refund of all federal income tax withheld because you expect to have no tax liability and had no tax liability in the previous tax year.

What is exempt from taxable income?

Exempt income includes things like distributions from some retirement accounts, gifts under a certain amount, certain benefits, and private insurance plans.

Is it better to claim 0 or 1 exemptions?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

What is an exemption on taxes?

An exemption is a dollar amount that can be deducted from an individual's total income, thereby reducing. the taxable income. Taxpayers may be able to claim two kinds of exemptions: • Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse)

What is an exemption on taxes example?

What Is a Tax Exemption? A tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the IRS, preventing them from having to pay income tax.

What is the best number of exemptions to claim?

You can claim anywhere between 0 and 3 allowances on the W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

How many tax exemptions should I claim?

If you are single and have one job, or married and filing jointly then claiming one allowance makes the most sense. An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately.

Is it better to claim 1 exemption or 0?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

Should I claim 1 exemption?

If you are single and have one job, or married and filing jointly then claiming one allowance makes the most sense. An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately.

How do I fill out a federal tax exemption?

To claim exempt, write EXEMPT under line 4c. You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income and o This year you expect a full refund of ALL federal income tax. NOTE: if you claim EXEMPT you must complete a new W-4 annually in February.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my UK Form TP4i directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your UK Form TP4i along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send UK Form TP4i for eSignature?

Once your UK Form TP4i is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I complete UK Form TP4i on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your UK Form TP4i from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is UK Form TP4(i)?

UK Form TP4(i) is a form used in the UK tax system that provides information related to the transfer pricing compliance of businesses. It is specifically designed to report transactions between connected parties.

Who is required to file UK Form TP4(i)?

Entities that engage in transactions with connected parties, typically multinational corporations or businesses with affiliates, are required to file UK Form TP4(i) to ensure compliance with transfer pricing regulations.

How to fill out UK Form TP4(i)?

To fill out UK Form TP4(i), entities must provide detailed information regarding their connected transactions, pricing methods used, and the rationale for those methods, ensuring accurate and complete reporting according to the guidelines provided by HMRC.

What is the purpose of UK Form TP4(i)?

The purpose of UK Form TP4(i) is to ensure that companies maintain arm's length pricing in their transactions with connected parties and to provide HM Revenue and Customs (HMRC) with the necessary information to assess compliance.

What information must be reported on UK Form TP4(i)?

UK Form TP4(i) requires reporting information such as the nature of the transaction, the parties involved, pricing methods adopted, documentation supporting the pricing, and any adjustments made to ensure compliance with tax regulations.

Fill out your UK Form TP4i online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK Form tp4i is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.